Introduction

The stability of the Indian arbitration landscape hinged on whether a court could invalidate a contractually agreed-upon interest rate simply because it appeared excessively high. The question of whether an arbitral award is liable to be set aside for granting a high rate of interest in a purely commercial contract specifically, whether such a stipulation amounts to patent illegality or is opposed to the public policy of India is a central focus in modern Arbitration Law.

The Supreme Court of India addressed this critical issue in the landmark case of BPL Limited v. Morgan Securities and Credits Private Limited1, pronounced by a Bench comprising Justice J. B. Pardiwala. The Court primarily held that a pre-agreed contractual rate of interest, even if high, cannot be termed unconscionable, arbitrary, or opposed to public policy in a commercial transaction between two business entities, provided the parties entered into the contract with informed consent and without duress.

The dispute arose from a Bill Discounting facility extended by the Respondent to a third party for which the Appellant, was the drawee and jointly and severally liable for repayment under the sanction letters dated on two dates. The facility offered a concessional interest rate of 22.5% per annum but stipulated a normal rate of 36% per annum in case of default. When the Appellant defaulted on payments amounting to over Rs. 25 crores in 2004, the Respondent invoked arbitration to recover the dues along with interest at the default rate.

Upholding the Contract: Court’s Stance on High Interest and Patent Illegality

The Appellant contended that the exorbitant rate of interest at 36% per annum was unconscionable and excessive, thereby violating the public policy of India and rendering the arbitral award patently illegal and liable to be set aside under Section 34 of the Arbitration Act2. They argued that the transactions should be governed by laws like the Usurious Loans Act3, or general principles of fairness and equity. The Respondent countered that the transaction was purely commercial between two corporate entities/traders, not a loan or debt falling under the Usurious Loans Act. They asserted that the interest rate was a mutually agreed-upon term in the contract, a fundamental principle being the sanctity of contract, and having benefited from the agreement, the Appellant could not avoid its stipulated obligations.

In its analysis, the Supreme Court referred to several judgments. Central Bank of India v. Ravindra and Others4 was relied upon by the Arbitrator to uphold the compounding of interest on monthly rests, as provided in the contract, affirming that interest can be added to the principal amount when agreed upon by the parties. In Modi Rubber Ltd v. Morgan Security and Credits5 affirmed that the Arbitrator relied on these to hold that the mutually agreed terms of payment of interest (36% per annum in case of default) were not unconscionable, arbitrary, or excessive in a commercial transaction between traders. The judgment further also delved into the Cavendish principle from Cavendish Square Holding BV v. Talal El Makdessi6, a cornerstone for deciding if a contractual clause is a penalty or a liquidated damage, and its embrace in foreign jurisdictions like Australia and New Zealand, though not explicitly deciding on its application in this context but discussing the nature of commercial contracts.

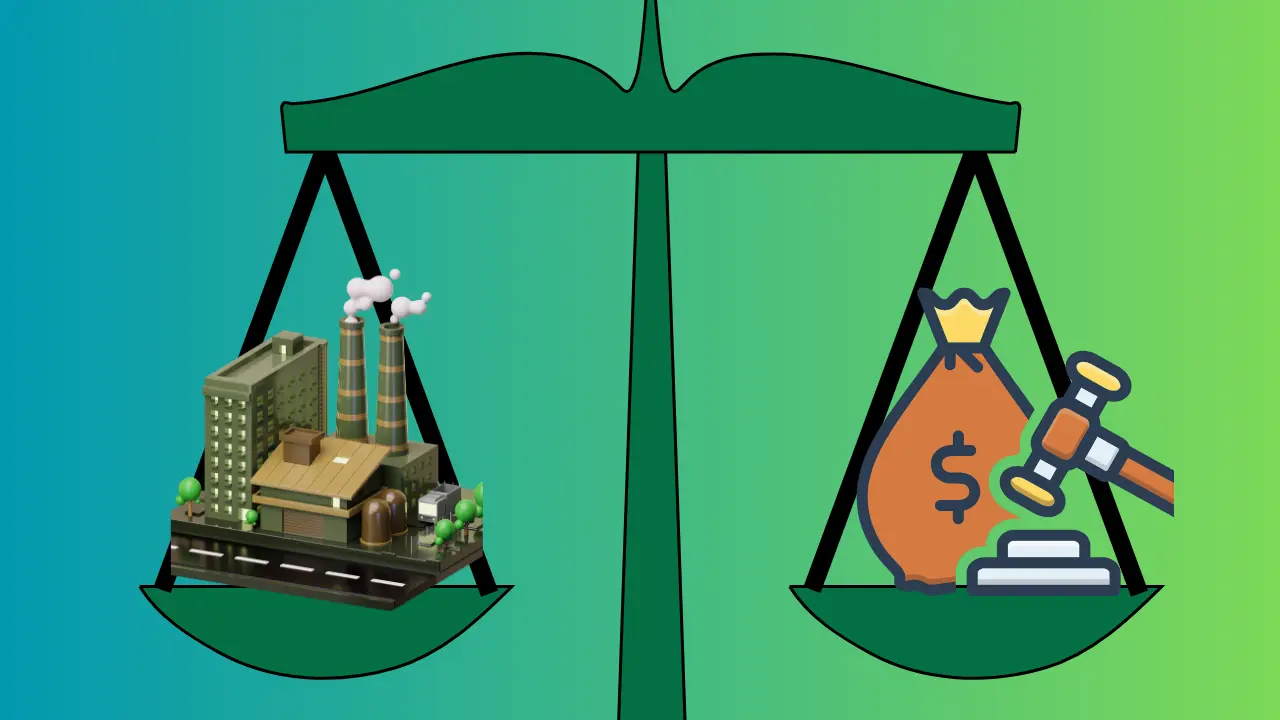

The Court essentially reaffirmed the judicial reluctance to interfere with the commercial wisdom of contracting parties, especially in the context of arbitration, unless the award is unconscionable to the extent of “shocking the conscience of the Court” or is fundamentally opposed to the “most basic notions of justice.” The Court, after hearing both sides, resolved the apparent dichotomy between the principle of ‘sanctity of contract’ and the ground of ‘public policy/patent illegality’ in the context of interest rates.

The Court affirmed the Arbitrator’s finding that the transaction was a commercial one (bill discounting) between two business entities/traders, not a loan under the Usurious Loans Act. It was held that simply because an interest rate is high (36%) does not make it unconscionable or against public policy when agreed upon by commercially savvy parties. The Court stressed that the Appellant was under no obligation to enter the contract but chose to reap its benefits. The Court reiterated the limited scope of intervention under Section 34 and Section 37 of the Arbitration Act. An error of law or fact is not a ground for setting aside an award; only illegality that goes to the root of the matter or violates the most basic notions of justice can warrant interference.

Ultimately, the Supreme Court dismissed the appeal, upholding the High Court’s Division Bench judgment, which in turn upheld the Arbitral Award (partially modified by the Single Judge regarding one bill of exchange on the issue of limitation). The Court thus validated the award of interest at 36% per annum till the date of the award and 10% thereafter till realization, based on the mutually agreed terms of the commercial contract.

Conclusion

The Supreme Court in BPL Limited (Supra) unequivocally reinforced the principle of contractual autonomy in commercial arbitration in India. The judgment affirms that a commercially agreed-upon high rate of interest, even 36% per annum upon default, does not automatically constitute a breach of public policy or patent illegality under Section 34 and 37 of the Arbitration and Conciliation Act, 1996, provided the contract was entered into with informed consent by two business entities.

The future ramifications of this judgment solidify the pro-enforcement stance of the Indian judiciary towards arbitral awards, particularly those arising from complex commercial agreements. It sends a strong signal to the commercial world that parties are generally bound by the terms they willingly negotiate and that courts will not intervene simply to re-evaluate the commercial prudence of a deal. This will enhance the predictability and finality of arbitration in India, making it a more reliable dispute resolution mechanism for business.

Will this judgment inadvertently encourage lenders to stipulate excessive default interest rates, relying on the ‘sanctity of contract’ shield? What is the definitive threshold for ‘unconscionability’ or ‘shocking the conscience of the Court’ concerning interest rates, if 36% is deemed acceptable? Should a higher scrutiny be applied to ‘penal’ interest clauses in contracts that show a significant disparity in bargaining power between the parties, even if both are technically ‘commercial entities’?

Citations

- BPL Limited v. Morgan Securities and Credits Private Limited (2025 INSC 1380)

- Arbitration and Conciliation Act, 1996

- Usurious Loans Act, 1918

- Central Bank of India v. Ravindra and Others (2001 SCC OnLine SC 1266)

- Modi Rubber Ltd v. Morgan Security and Credits (2002 SCC OnLine Del 546)

- Cavendish Square Holding BV v. Talal El Makdessi [2015] UKSC 67

Expositor(s): Adv. Shreya Mishra