This article discusses the strategic measures businesses and investors need to mitigate the implications of Switzerland’s decision to revoke India’s MFN status under DTAA.

Introduction

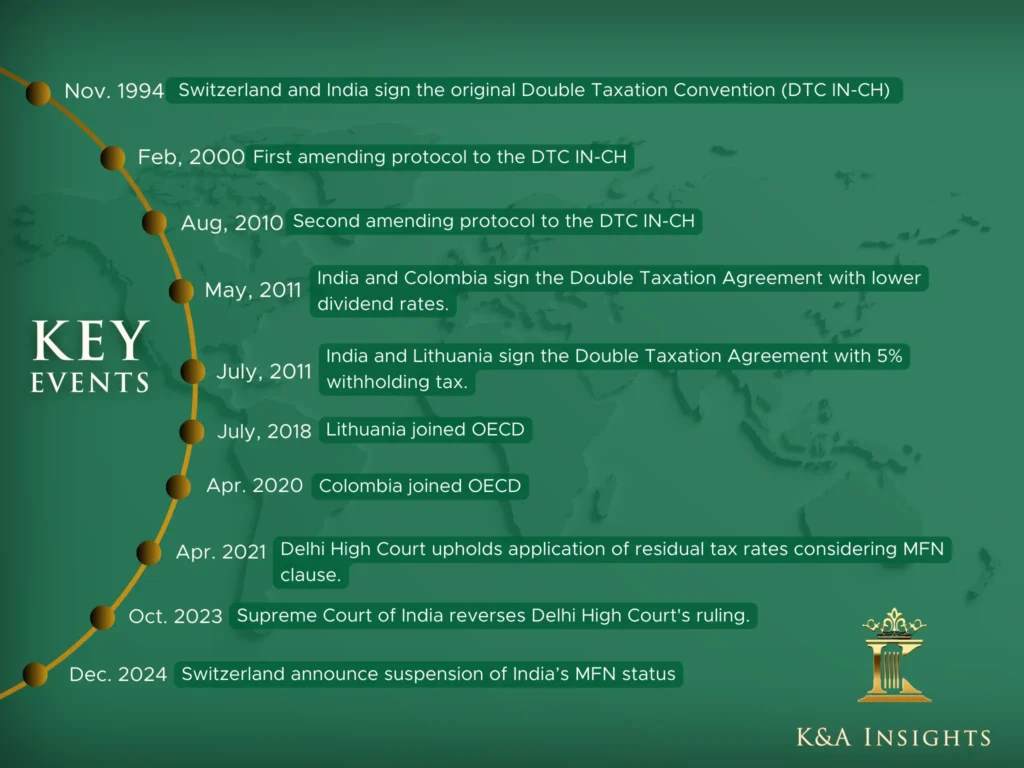

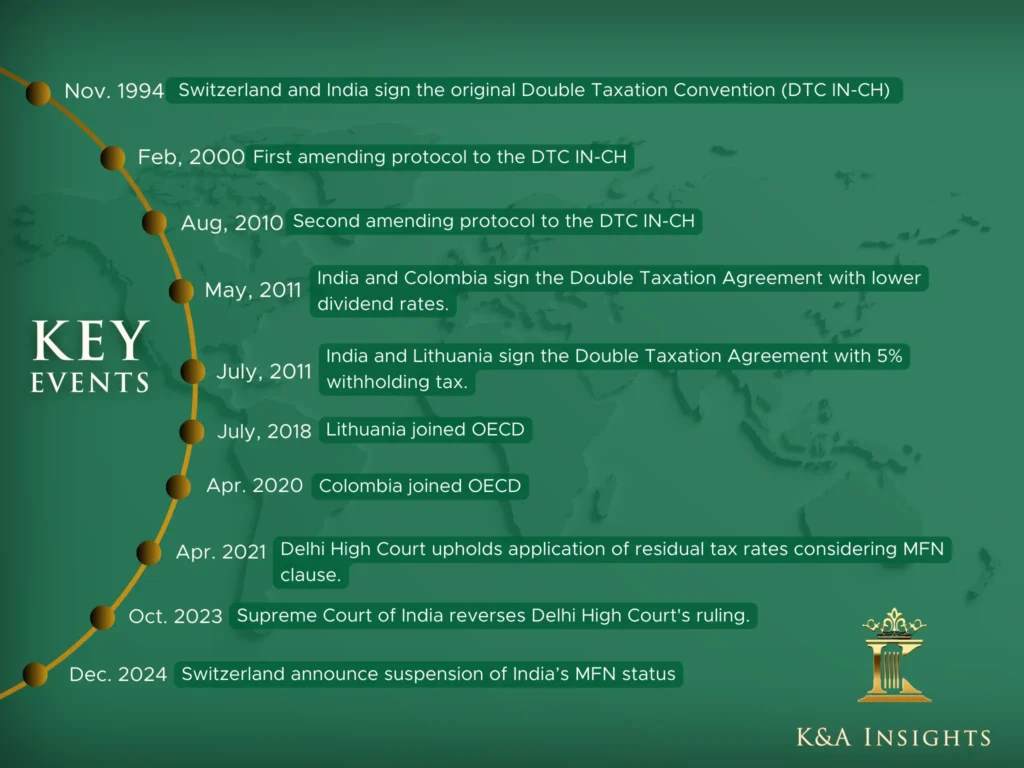

In a pivotal development last week, the Swiss Federal Department of Finance (DFF) announced the revocation of the unilateral application of the Most Favored Nation (MFN) with India under the Double Tax Avoidance Agreement (DTAA). This change, effective from January 1, 2025, will increase the withholding tax on dividends from the current 5% to 10%. The decision follows a significant judgement by the Supreme Court of India in the case [Assessing Officer Circle (International Taxation) New Delhi v. M/s Nestle SA],¹ where a two-judge bench, comprising Justice Dipankar Datta and Justice S. Ravindra Bhat overturned rulings by the Delhi High Court and settled a long-standing controversy on the operation and interpretation of the MFN clause.

The Delhi High Court’s rulings in Concentrix Services Netherlands B.V. v. Income Tax Officer (TDS)² and Nestle SA v. Assessing Officer³ had previously interpreted the MFN clause in a manner favorable to taxpayers. However, the Supreme Court’s reversal of these decisions and Switzerland’s subsequent action has far reaching implications for businesses and investors who had relied on the lower withholding tax rate.

Understanding the MFN Clause in DTAAs

A Double Tax Avoidance Agreement (DTAA) is a bilateral framework that prevents income from being taxed in both the source and residence countries, facilitating smoother cross-border investments. One key feature of such treaties is the Most Favored Nation (MFN) clause. This provision ensures that residents of one signatory country are granted tax treatment at least as favorable as that extended to a third country under another DTAA.

The MFN clause is rooted in the principle of non-discrimination, and its scope often includes income types such as dividends, royalties, interest, or fees for technical services. In practice, the clause offers businesses a preferential tax regime if a more favorable rate is granted to another country, thereby encouraging international investment. With Switzerland’s decision to revoke the unilateral application of this clause, the affected withholding tax rate will place a heavier burden on companies and investors.

Backdrop

Steria India (a French company’s subsidiary), claimed a reduced tax rate on fees for technical services (FTS). Steria advocated for including FTS in the India-France DTAA, citing the more restrictive definition of FTS found in the India-UK DTAA. The Authority of Advance Ruling (AAR) dismissed this argument, ruling that Section 90(1) of the Income Tax Act mandated a second government announcement to comply with the MFN provision. However, the Delhi High Court ruled in favor of Steria (Steria (India) Ltd. v. Commissioner of Income Tax)4. The High Court delved into the interpretation of clause 7 of the Protocol (attached to the India-France DTAA) which permits the application of more beneficial tax rates or scopes from other DTAA conventions between India and OECD members. The court held that once the DTAA and its Protocol have been notified, the advantageous terms from other pertinent DTAAs are also incorporated.

Similarly, Dutch companies Concentrix Services Netherlands BV and Optum Global Solutions International BV sought a reduced tax rate on FTS under the India-Netherlands DTAA, leveraging the MFN clause. The Delhi High Court ruled in favor of the Dutch companies, applying the principle of parity and holding that the MFN clause is automatically applicable without a separate notification.

Nestle SA, a Swiss corporation, invoked the MFN clause in the India-Switzerland DTAA to seek a lower dividend tax rate and argued that the India-Switzerland DTAA should be granted the same benefits as those provided in the India-Lithuania DTAA (5% dividend tax rate). Lithuania was not a member of the OECD when the DTAA with India was signed. The Delhi High Court held that the MFN clause applies automatically and India should extend the same benefits to Switzerland as to Lithuania. The court also held that the MFN clause is applicable even if India entered into a DTAA with a country before their membership in the OECD. Hence, OECD membership status was irrelevant to invoking the MFN clause.

Key Issues

- Whether the MFN provision applies automatically or requires a separate government notification in terms of section 90(1) of the Income Tax Act, 1961.

- Whether a country’s OECD membership at the time of signing the DTAA or at the time of invoking the MFN clause is crucial- Interpretation of “which is a member of OECD” in the Protocol’s MFN clause.

Judgement

- The Supreme Court bench held that the MFN clause cannot take effect unless a separate notification is issued per section 90(1) of the Income Tax Act.

- Furthermore, it held that the members of the OECD who were present when the DTAA with India was signed are the only ones covered by the MFN clause. The interpretation of the word “is” in the MFN clause means that, for a party to assert the advantages of the clause resulting from the entry of a DTAA between India and another state, the date of the treaty’s signing is relevant, not the date on which the other state joins the OECD. The SC recognized that membership in the OECD is a dynamic concept that could further evolve.

Implications and Strategic Adjustments

The MFN clause works on ‘Principle of Reciprocity’ wherein both countries benefit from each. This principle allows countries to withdraw benefits if they are not reciprocated. The revocation of the MFN clause by Switzerland increases the withholding tax on dividends paid to Indian companies from 5% to 10%. This increase will have significant implications for businesses and investors. Indian companies in sectors such as pharmaceuticals, technology, and financial services, as well as multinational corporations that structured investments around the 5% rate, will face increased tax liabilities. Smaller businesses or new investors may find Swiss markets less attractive due to the higher tax costs.

However, it is important to note that Switzerland will continue to honor the DTAA benefits for Indian companies operating in Switzerland on other items, and dividends paid by Swiss companies to India will remain taxed at 10%, as has always been the case. The changes are unlikely to impact investments into India from the European Free Trade Association (EFTA) countries, as their tax arrangements are unaffected by this revision.

Beyond the immediate tax impact, the policy shift introduces uncertainty in the international tax landscape. Other countries may follow suit, prompting businesses to reassess their global tax strategies and investment structures. Professionals should review their clients’ positions, identify areas of increased liability, and consider tax credits or exemptions from other jurisdictions to mitigate the impact.

1 2023 SCC OnLine SC 1372

2 2021 SCC OnLine Del 2563

3 2021 SCC OnLine Del 5768

4 2016 SCC OnLine Del 4207