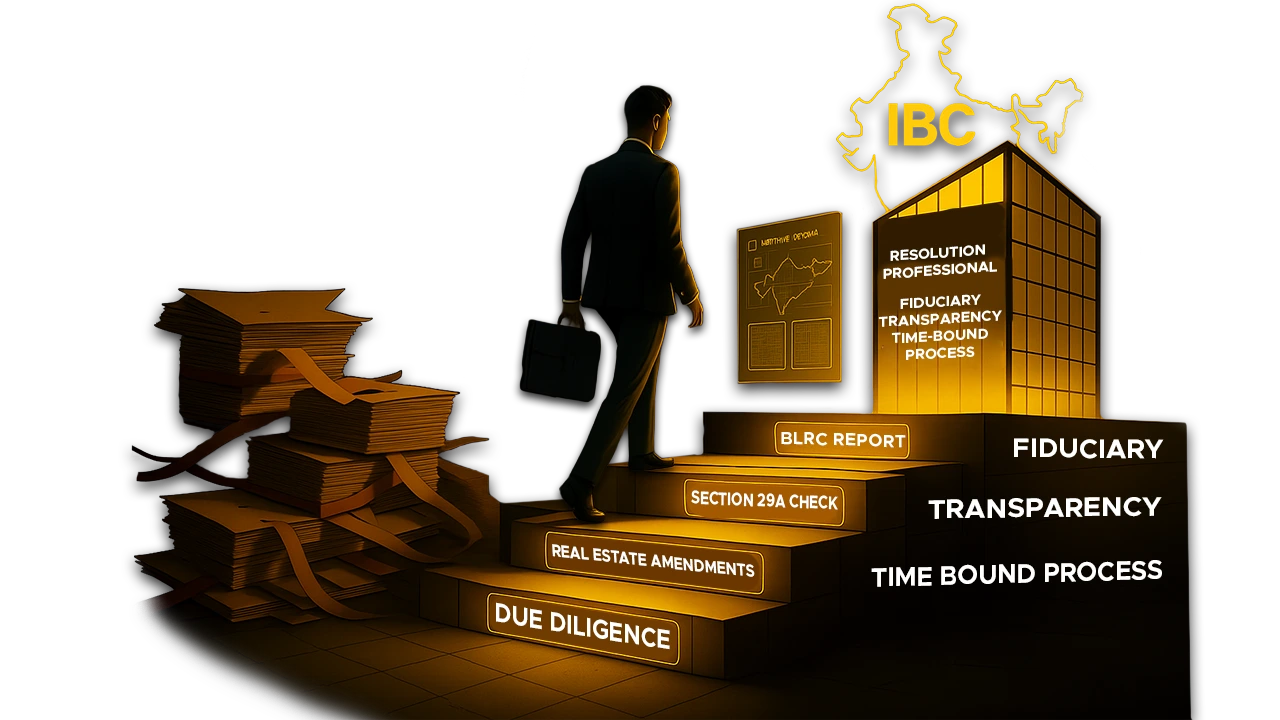

IBC has fundamentally reshaped India’s corporate insolvency landscape to a time-bound, creditor-in-control, and market-driven process. At the core of this transformative framework stands the Resolution Professional (RP), an individual tasked with the monumental responsibility of steering a distressed corporate entity through the turbulent waters of the CIRP1. The role of the RP, once envisioned as primarily administrative, has undergone a significant evolution, shaped by a dynamic interplay of statutory amendments, regulatory refinements, and a series of landmark judicial pronouncements. Today, the RP is not merely a manager of the corporate debtor’s affairs but a central fiduciary, a compliance officer, and a crucial link between the debtor, its creditors, and the adjudicating authorities. This evolution brings about a broader shift towards professional accountability and ethical governance under the legislation.

From Bureaucratic Inertia to a Professional-Led Framework

Prior to IBC, India’s insolvency regime was fragmented and plagued by institutional inefficiencies. The liquidation process under the Companies Act and the restructuring framework under the SICA2 were largely managed by government-appointed officials like Official Liquidators and administrators from the Board for Industrial and Financial Reconstruction. These regimes were often characterised by procedural red tape, inordinate delays, and a lack of commercial expertise, which led to significant erosion of enterprise value and a loss of investor confidence.

The BLRC3, in its 2015 report, identified these systemic flaws, noting that creditors had little to no control, defaulting debtors retained management, and resolution timelines were virtually non-existent. The BLRC proposed a paradigm shift: a creditor-in-control model managed by a new class of licensed Insolvency Professionals. The IBC brought this vision to life, creating the role of the Resolution Professional to act as an independent fiduciary, empowered to manage the corporate debtor’s affairs during the insolvency process. This marked a definitive move away from a bureaucratic system to a professional-led framework, placing the RP as the central operational figure responsible for running the corporate debtor as a going concern and conducting the resolution process with accountability and transparency.

The Broadening Canvas of Responsibilities and Duties

The powers and responsibilities of the RP are extensive, flowing from the IBC and the regulations framed by the IBBI4. Upon appointment, the RP takes over the management and control of the corporate debtor, effectively replacing its board of directors. Key statutory powers include taking custody of the debtor’s assets, constituting and convening meetings of CoC5, inviting and evaluating resolution plans, and managing the company’s operations as a going concern. The RP is also duty-bound to file applications to avoid preferential, undervalued, fraudulent, or extortionate transactions, a critical function for value maximization.

A core function of the RP is the meticulous process of receiving, verifying, and collating claims from all creditors. This administrative, yet crucial, task forms the bedrock for the constitution of CoC and subsequent distribution of proceeds. The judiciary has consistently emphasised that while the RP’s role in claims verification is not adjudicatory, it must be performed with utmost professional diligence and impartiality.

The Supreme Court, in State Tax Officer v. Rainbow Papers Ltd.6, expanded the RP’s duty clarifying that the RP must take reasonable steps to identify and include known statutory liabilities, such as tax dues, even if a formal claim has not been submitted by the relevant government authority. This places a proactive responsibility on the RP to go beyond the claims formally filed and to scrutinise the corporate debtor’s financial records to provisionally admit liabilities reflected in the books of account. Failure to do so could lead to such claims being extinguished upon the approval of a resolution plan, potentially triggering post-resolution litigation and disrupting the plan’s implementation.

Ethical Obligations and the ‘Public Servant’ Conundrum

The role of the RP is governed by a stringent code of conduct and ethical standards. As licensed professionals under the oversight of the IBBI, RPs must uphold high standards of integrity, objectivity, and confidentiality. A significant development in this area came from the Jharkhand High Court in Sanjay Kumar Agarwal v. Union of India7, which held that RPs are “public servants” under the Prevention of Corruption Act, 1988. The court reasoned that since RPs perform functions in the public interest, such as managing debt-laden companies and protecting the interests of creditors (many of whom are public sector banks dealing with public money), they discharge a public duty. Their appointment, being under the supervision and approval of the NCLT, carries a statutory imprimatur, distinguishing it from a purely private contract.

The court held that the protection granted to RPs under Section 233 IBC for actions taken in good faith does not provide a shield against allegations of corruption or abuse of their public function. This judgment amplifies the accountability standards for RPs, reinforcing that their conduct, especially when handling public funds through financial creditors, must be beyond reproach.

Navigating Sector-Specific Challenges: The Case of Real Estate

The amendments to the IBC have introduced significant changes to the RP’s role in the context of real estate insolvencies, a sector fraught with unique challenges. These amendments, aimed at protecting homebuyers and facilitating project-specific resolutions, have reshaped the RP’s responsibilities. Under this new regime, an RP is required to ring-fence the assets and liabilities of individual projects within a real estate company, maintain separate books of account for each project, and facilitate project-wise resolution plans.

This approach was judicially endorsed even before the amendments in the NCLAT ruling of Flat Buyer Association v. Umang Realtech Pvt. Ltd.8, which held that real estate insolvency must focus on resolving individual projects. The recent amendments have codified this, adding further responsibilities for the RP, such as handing over possession of completed units to allottees and submitting detailed reports on development rights. These changes demand that RPs in real estate cases act as project-level fiduciaries, adeptly balancing the interests of homebuyers, financial institutions, and regulatory authorities to achieve a holistic resolution.

Lessons from the Apex Court: Defining the Contours of the RP’s Role

A series of landmark judgments from the Supreme Court has been instrumental in clarifying and defining the operational boundaries of the Resolution Professional.

In the seminal case of Committee of Creditors of Essar Steel India Ltd. v. Satish Kumar Gupta & Ors.9, the Supreme Court clarified that the RP’s role is administrative and not adjudicatory. The RP’s duty is to ensure that a resolution plan complies with the mandatory requirements of Section 30(2) of the IBC, but the ultimate decision on the commercial viability of the plan rests solely with the CoC. The RP cannot usurp the commercial wisdom of the creditors.

The critical importance of the RP’s due diligence function, particularly in verifying the eligibility of resolution applicants under Section 29A, has been repeatedly emphasized. In ArcelorMittal India Pvt. Ltd. v. Satish Kumar Gupta & Ors.10, the Court scrutinized the RP’s diligence in investigating “connected persons” of the resolution applicant. This theme was central to the recent and impactful judgment in Kalyani Transco vs Bhushan Power And Steel Ltd11, decided on May 2 2025. In this case, the Supreme Court set aside an approved resolution plan due to severe procedural violations, including the RP’s failure to independently verify and certify the applicant’s Section 29A eligibility and the plan’s compliance with the law. The BPSL judgment serves as a stark reminder that the RP’s due diligence is non-negotiable and that procedural discipline is foundational to the integrity of the CIRP. The RP cannot simply rely on an affidavit from the applicant but must conduct an independent verification.

The Supreme Court’s decision in Saranga Anilkumar Aggarwal v. Bhavesh Dhirajlal Sheth & Ors.12 provided clarity on the scope of the moratorium under the IBC. The Court held that regulatory penalties, such as those imposed under consumer protection laws, do not qualify as “debt” under the IBC and are therefore not stayed by the moratorium. This implies that RPs must identify and account for such regulatory claims during the CIRP, as they may survive the resolution plan if not properly addressed.

Conclusion

The journey of the Resolution Professional under the IBC has been one of continuous evolution and increasing responsibility. From being a procedural administrator, the RP has emerged as a linchpin of the insolvency ecosystem, entrusted with a fiduciary duty to all stakeholders. The evolving jurisprudence makes it clear that RPs are expected to act with the highest degree of diligence, transparency, and ethical integrity. They must proactively identify and address complex issues, from unfulfilled statutory claims and potential avoidance transactions to the eligibility of resolution applicants and the proper constitution of the insolvency estate. As the gatekeeper of the CIRP, the RP’s unwavering commitment to operating strictly within the four corners of the law is paramount to preserving the credibility and effectiveness of India’s insolvency resolution framework.

Citations

- CIRP – Corporate Insolvency Resolution Process

- SICA – Sick Industrial Companies (Special Provisions) Act, 1985

- BLRC – Bankruptcy Law Reforms Committee

- IBBI – Insolvency and Bankruptcy Board of India

- CoC – Committee of Creditors

- CIVIL APPEAL NO. 1661 OF 2020

- Criminal Revision No. 728 of 2023

- Company Appeal (AT) (Ins.) No.926 of 2019

- CIVIL APPEAL NO. 8766-67 OF 2019

- CIVIL APPEAL NOs.9402-9405 OF 2018

- CIVIL APPEAL NO. 1808 of 2020

- CIVIL APPEAL NO(S). 4048 OF 2024

Expositor(s): Adv. Khushboo Saraf