Introduction

The Prevention of Money Laundering Act, 2002 (PMLA) is the primary legislation in India dealing with the offence of money laundering. Stringent provisions have been incorporated under the PMLA to deal with offenders possessing proceeds of crime. Furthermore, the PMLA also provides for the restoration of tainted property to an innocent purchaser or a legitimate interest holder by severing the link between offenders and the ill-gotten gains derived from such proceeds.

Chapter III of the PMLA establishes a robust framework for the attachment, seizure, and confiscation of tainted properties. It also sets out the adjudication process for these actions. Section 8(3) of the PMLA empowers the Adjudicating Authority to confirm the attachment, seizure, or freezing of a property if it is satisfied that such property is involved in the offence of money laundering.

Clause (8) of Section 8 of the PMLA was inserted by the Finance Act of 2015, which states that the special court can direct the restoration of the confiscated property or any part thereof to a claimant possessing a legitimate interest in the property.

The second proviso to Section 8(8) of the PMLA was introduced by the Amendment Act of 2018, enabling the special court to direct the restoration of the property to the claimant during the trial if it deems fit.

The Central Government introduced the Prevention of Money Laundering (Restoration of Confiscated Property) Rules, 2016 (the RCP Rules) under Section 8(8) of the PMLA to streamline the process of restoring tainted properties to claimants possessing a legitimate interest. These rules govern the manner of restoration of confiscated property and the adjudication of claims seeking such restoration.

In this article, we will examine the provisions relating to the attachment of property and its restoration to the rightful claimant within the framework of the PMLA.

Scheme Of Money Laundering

The offence of money laundering is directly connected to the commission of a predicate offence. Predicate offences are those offences that have been enlisted in the schedule appended to the PMLA.

When funds are generated from the commission of a scheduled offence, such funds metamorphose into properties known as proceeds of crime under Section 2(1)(u) of the PMLA. The definition of proceeds of crime under the PMLA is very broad, encompassing properties derived or obtained from the scheduled offence. It also includes any property that is directly or indirectly linked to any criminal activity associated with the scheduled offence.

The existence of proceeds of crime gives rise to the offence of money laundering. Section 3 of the PMLA defines money laundering as any direct or indirect indulgence, assistance, or participation in any process or activity connected with the proceeds of crime.

The primary objective of the PMLA is to secure the proceeds of crime, prevent offenders from enjoying the fruits of their ill-gotten gains, and deprive them of the opportunity to dispose of such properties. This is achieved through the attachment, seizure, or freezing of such property.

Attachment Of Property under the PMLA

Section 5(1) of the PMLA empowers the Enforcement Directorate (ED) to issue a written order for the provisional attachment of property. Such an order can be passed by the Deputy Director only when he is convinced and has reason to believe that a person is in possession of proceeds of crime and that such proceeds are likely to be concealed, transferred, or dealt with in a manner that may frustrate proceedings related to their confiscation.

Section 5(4) further provides that the attachment of an immovable property under Section 5(1) would not deprive the interested person of the right to enjoy such property. An interested person refers to anyone who is claiming or entitled to claim an interest in the property.

A property attached under Section 5(1) of the PMLA can be confirmed by the court under Section 8(3) after giving the aggrieved party an opportunity to be heard. Section 8(4) further states that once the court confirms the attachment of the property, the Enforcement Directorate (ED) is empowered to take possession of the attached property.

Additionally, Section 8(6) provides that the court shall order the release of the property if, after the trial, it is found that no offence of money laundering has been committed or that the attached property was not involved in the offence of money laundering.

Seizure and Freezing of Property under the PMLA

Section 17(1) of the PMLA empowers the Enforcement Directorate (ED) to search and seize records or property. This section comes into operation when the ED possesses information or has reason to believe that a person has committed an act constituting the offence of money laundering, is in possession of proceeds of crime involved in money laundering, holds records related to money laundering, or possesses any property linked to a crime.

A bare reading of the above section makes it clear that the ED’s power regarding the persons subject to searches and property seizures is very broad. Furthermore, it is not sine qua non that a person must be accused of money laundering under Section 3 before the ED can initiate a search or seize records or property. Even if a person merely possesses property related to a crime, they fall within the ambit of Section 17 of the PMLA.

Where the seizure of a property is impracticable, Section 17(1A) of the PMLA allows the Enforcement Directorate (ED) to freeze the property. Once a property is frozen, it cannot be transferred without the permission of the authority that imposed the freeze.

When a property is seized or frozen by the ED, such seizure or freeze can be confirmed by the court in the same manner as the order of attachment of the property.

Management and Restoration of Attached or Confiscated Property

The RCP Rules provide the procedure for the restoration of attached or confiscated property. Rule 3 lays down the procedure to restore property to the claimant when an offence of money laundering is proven to have been committed after the trial. Rule 3A, introduced through an amendment in 2019, empowers the claimant to seek restoration of the property during the pendency of the trial.

When an offence of money laundering is proved, the court, under Section 8(5) of the PMLA, is obligated to pass an order of confiscation of the property. Section 8(5), read with Section 9, makes it clear that once the order of confiscation is passed, all rights and titles in such property shall vest in the Central Government without any encumbrances.

Rule 3(1) enjoins the court to invite individuals claiming a legitimate interest in the property after an order of confiscation is passed. Furthermore, Rule 3(2) provides that if the confiscated property is insufficient to cover the loss suffered by the claimants due to the offence of money laundering, the restoration of the property must be carried out on a pro rata basis.

When the trial for the offence of money laundering is pending, the order confirming the attachment, seizure, or freezing of property remains in effect.

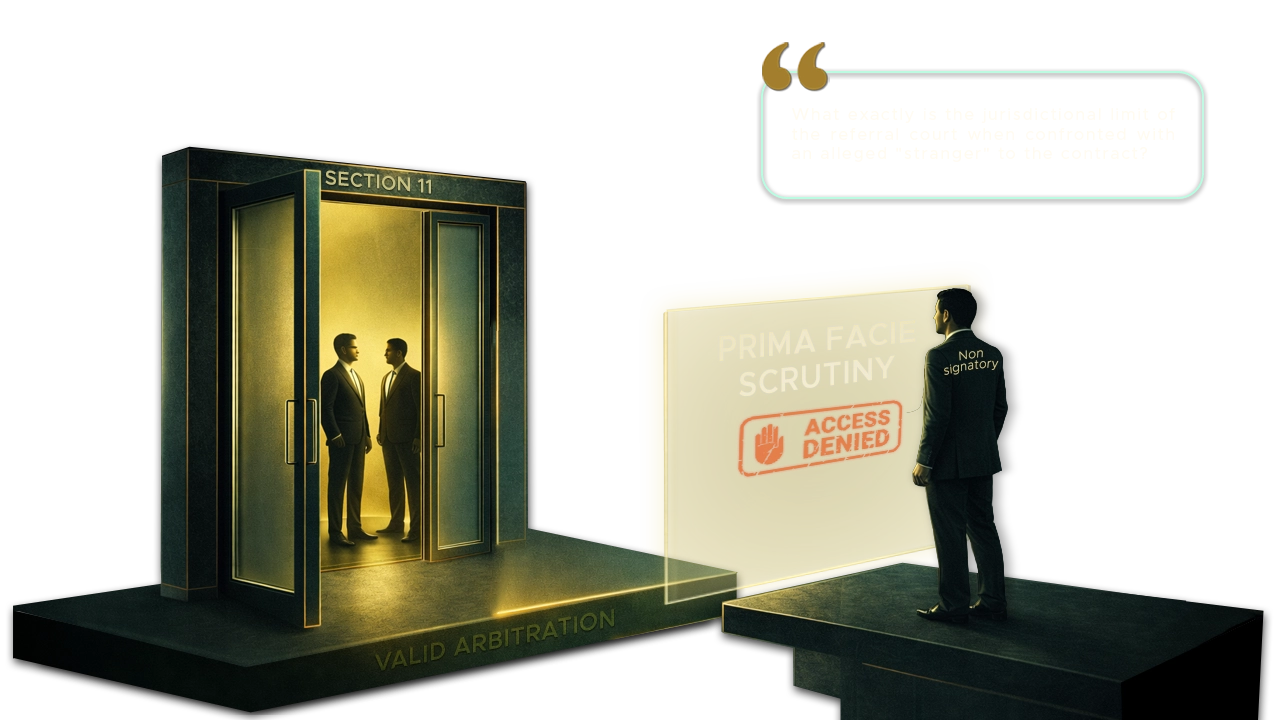

Once charges under Section 4 of the PMLA have been framed, the court, under Rule 3A(1), is mandated to invite claims from individuals with a legitimate interest in any part of the attached, seized, or frozen property.

Rule 3A(2) further provides that if the confiscated property is insufficient to cover the losses suffered by the claimants, the restoration of the property must be carried out on a pro rata basis after the auction of such property. Alternatively, the court can allow the claimant to take custody of the property with a stipulation that the property shall be produced when required.

Adjudication and Rights of a claimant in Tainted property

Section 8(8), read with Rule 2(b), delineates the qualifications for a claimant. A claimant is defined as an innocent person who has acted in good faith and suffered a loss despite taking sufficient precautions.

Once a property is attached and the attachment is pending confirmation before the court, a reasonable opportunity of being heard is provided to the aggrieved person, as per the proviso to Section 8(8) of the PMLA. However, a glaring shortcoming of this provision is that the burden of proving that the attached property was purchased innocently rests on the claimant. This application of reverse burden of proof stems from Section 24 of the PMLA, which stipulates that the court shall presume the involvement of proceeds of crime in the offence of money laundering.

While the provision stipulates that necessary steps should be taken before buying or investing in a property, no specific standards or guidelines have been laid down to determine when it can be said that due diligence has been exercised.

The question of burden of proof under Section 8(8) of the PMLA came up for consideration before the Delhi High Court in Enforcement Directorate v. Axis Bank. The court held that the extent of the burden of proof to be discharged by the claimant depends on the timing of the purchase of the property. The court further observed that if the property was purchased by the claimant before the commission of the offence involving proscribed criminal activity, the burden to demonstrate that the purchase was made after reasonable due diligence would be lesser compared to when the property was purchased around or after the commission of the offence.

The former test is reasonable, but when it comes to purchasing property around or after the commission of the offence, the claimant must undertake a comprehensive inquiry, including investigating any potential money laundering angle, before purchasing the property.

Another issue with this test is that it fails to distinguish between purchasers who acquire the property before and after the commission of the offence. If a person purchases a property before its integration into proceeds of crime, such a transaction should be considered innocent. However, the statute fails to address this lacuna.

Once a property is designated as tainted, the burden of proof shifts to the claimant to demonstrate that the purchase was made innocently, irrespective of the fact that the property was purchased before the commission of the offence, which appears to be unfair.

Remedies Against Attachment of property

Under the PMLA, the attachment of a property prohibits its transfer, conversion, disposition, or movement pursuant to an order of attachment. The statute does not distinguish between an attachment order passed by the ED and an order confirming the attachment issued by the court. This means that the moment the ED passes an attachment order, the claimant is prohibited from dealing with the property in any manner whatsoever.

Once a property is attached by the ED, such attachment remains in effect for 180 days or until the court passes an order confirming the attachment under Section 8(3), whichever is earlier. At this stage, the accused can merely enjoy the property if it is immovable. However, once the court confirms the attachment or freeze under Section 8(4) of the PMLA, the ED is entitled to take possession of the property. After this stage, it is at the ED’s discretion whether the accused should be allowed to continue enjoying the property or if it should be taken into its possession.

Section 8(3) of the PMLA empowers the court to confirm the attachment, seizure, or freezing of property by the ED. While confirming any of these actions, the court must also specify the duration for which the attachment, seizure, or freeze will remain in effect. As per Section 8(3)(a), the attachment of property by the ED will continue for 365 days or during the pendency of proceedings related to any offence under the Act. The attachment may become final once an order of confirmation is passed under Section 8(3)(b). If the investigation extends beyond one year, the court may order the restoration of the property.

The scope of the phrase “during the pendency of the proceedings of the offence under the Act” was examined by the Delhi High Court in Mahender Kumar Khandelwal v. Enforcement Directorate where it was held that the term “proceedings” does not extend to proceedings related to the predicate offence if the appellants or other individuals are not named, or if the proceedings are unrelated to the confiscated property. The court clarified that the scope of this section is limited to proceedings concerning an offence under the PMLA.

Additionally, the court noted that the accused-appellant was not named in the scheduled offence, and a significant period had elapsed. Based on this, the court ruled that the attached property must be released if the 365-day period has expired. Similarly, in Seema Garg vs Assistant Director,the Punjab and Haryana High Court held that the accused is entitled to have the provisional attachment lifted once the 365-day period has lapsed and the investigation is still pending.

The 365-day time limit for property attachment serves as a safeguard against the ED’s ability to unnecessarily prolong investigations. Any delay in completing the investigation should not work to the disadvantage of the accused. Prolonged attachment of property, without justifiable cause, would impose undue hardship on the accused and lacks a rational basis.

Section 8(4)- Constitutionality Challenged

The constitutionality of this provision was challenged before the Supreme Court in Vijay Madanlal Choudhary v. Union of India, where the court held that an order of attachment under Section 5(1) of the PMLA is merely notional. The court further clarified that even if an order confirming the attachment is passed under Section 8(3), the right to enjoy the property remains intact until an order of confiscation is issued. This means that under Section 5(4), the claimant retains the right to use the property until it is formally confiscated. The court effectively ruled that the ED should refrain from physically taking possession of the property until the confiscation order is passed.

Conclusion

It can be concluded that the burden of proof imposed on the claimant to demonstrate that the property was purchased in good faith or with due diligence seems unfair, as it is nearly impossible to trace the complete transactional history of the subject property. Additionally, it is exceedingly difficult to determine whether the property was ever involved in the offence of money laundering. Such challenges ultimately disadvantage claimants who purchased the property in good faith and exercised due diligence but were still unable to detect any connection to money laundering.

Furthermore, while the Supreme Court’s ruling in Vijay Madanlal Choudary(supra) the ED should not take physical possession of the attached property until a confiscation order is passed, the absence of clear guidelines creates ambiguity.

The lack of specific criteria leaves room for subjective interpretation by the ED, which could lead to inconsistent application of the law. A well-defined framework outlining the circumstances under which the ED can take possession would help balance the interests of enforcement with the rights of innocent purchasers and claimants. Until such guidelines are in place, the discretionary power of the ED remains broad, potentially affecting those who have acquired property in good faith.

- CRL.A. 143/2018 & Crl.M.A. 2262/2018.

- W.P.(C) 10993/2023 & CM APPL. 42616/2023.

- CRM-M-3468-2022 (O&M)

- SPECIAL LEAVE PETITION (CRIMINAL) NO. 4634 OF 2014.