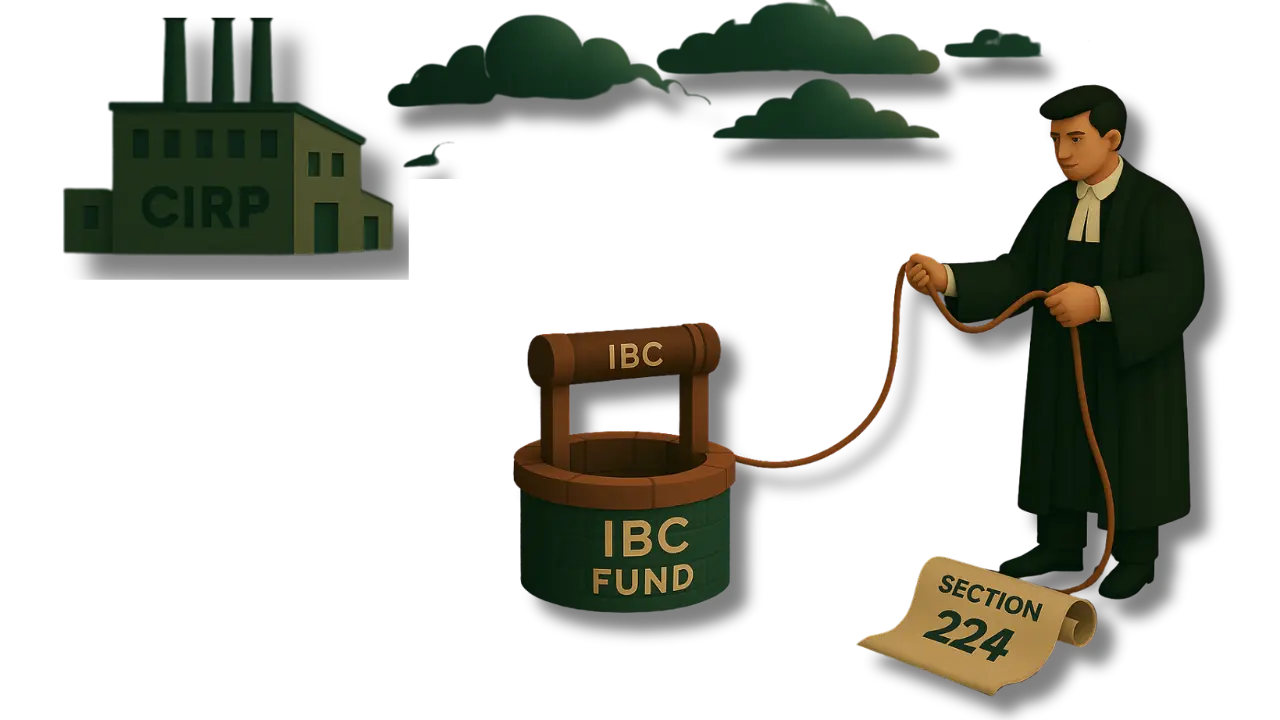

IBC since its inception, has provisions in section 224 under Part V for the constitution of Insolvency & Bankruptcy Fund (I&B Fund). However, little progress has been made on this front. The objective for creation of the said fund is to support the insolvency resolution, liquidation, and bankruptcy of individuals and businesses under the IBC. In this article, we will analyse the relevance of this provision in strengthening the insolvency ecosystem in the country by empowering the insolvency professionals and rescuing them in situations of financial crisis, such as interim finance, delays in payment of CIRP cost/ liquidation cost, audit costs before the Insolvency Commencement Date, etc.

The IBC’s journey has been marked by significant progress, yet it continues to grapple with practical hurdles that often impede the smooth functioning of insolvency proceedings. One of the most pressing concerns revolves around the financial viability of conducting these processes, especially in cases where the Corporate Debtor (CD) possesses limited or no realisable assets. Imagine a scenario where an insolvency professional (IP) is appointed to oversee the CIRP of a company that, upon initial assessment, reveals a severe dearth of assets. The Committee of Creditors (CoC), faced with the prospect of funding a process with little hope of recovery, often becomes reluctant to incur the necessary CIRP costs. This leaves the IP in a precarious position, frequently having to bear expenses from their own pocket, with little to no assurance of reimbursement. Such situations not only create immense financial strain for IPs but also jeopardise the very objective of the CIRP, as critical steps might be stalled or compromised due to a lack of funds. This is precisely where the I&B Fund, if operationalised effectively, could step in as a crucial safety net, ensuring that the resolution process, regardless of the corporate debtor’s financial state, is not derailed by a lack of interim finance or the inability to cover essential costs.

Section 224 IBC outlines the formation and purpose of the I&B Fund. It stipulates that the Fund shall be established for the purposes of insolvency resolution, liquidation, and bankruptcy of persons under IBC. The envisioned sources of the Fund include grants from the Central Government, contributions from individuals, amounts received from any other source, and interest or other income generated from its investments. Furthermore, IBC allows contributors to withdraw funds, up to their contributed amount, for specific purposes such as making payments to workmen, protecting assets, or meeting incidental costs during proceedings. Despite this clear legislative intent, the “prescribed” manner of its administration and operationalisation, as per Section 3(26), has not yet been fully defined or implemented through rules. This regulatory void has left the I&B Fund as a provision on paper, rather than a functional mechanism.

The Insolvency Law Committee (ILC), has repeatedly highlighted the necessity of operationalising the I&B Fund. In its First Report (March 2018) the ILC acknowledged the Fund’s role in providing additional funds for insolvency proceedings, especially when assets are scarce.1 More significantly, the Fifth ILC Report (May 2022) delved deeper into the challenges.2 It noted that the current design of Section 224 does not adequately incentivise contributions, as contributions are largely voluntary and utilisation is limited. The Committee emphasised the need for building incentives or mandates for contributions, suggesting a review of similar funds in other statutes, such as the Investor Protection and Education Fund under the SEBI Act, 1992, and the Investor Education and Protection Fund under the Companies Act, 2013. These observations underscore a fundamental truth: a fund, no matter how well-intentioned, cannot fulfil its purpose without a robust framework for both its corpus generation and its judicious deployment.

To augment the sources of funds for the I&B Fund, several practical recommendations have emerged. One prominent proposal is to mandate a contribution of approximately 0.25% to 0.50% of the resolution plan amount by the Successful Resolution Applicant (SRA). This would ensure that a portion of the value realised through the resolution process directly contributes to the Fund, making it a self-sustaining mechanism. This would necessitate an amendment to Regulation 31A(1) of the CIRP Regulations, shifting the burden of this contribution from creditors to the SRA, thereby aligning it more closely with the spirit of resolution. Similarly, a proposed percentage of the sale proceeds under liquidation, perhaps 0.25% to 0.50%, could be contributed by the successful bidder. Furthermore, the I&B Fund could actively earn interest by contributing to interim finance during the CIRP process, transforming it from a passive repository into an active participant in the financial ecosystem of insolvency. These proposed sources, if implemented, would collectively create a substantial and sustainable corpus, providing the necessary financial muscle for the Fund to address the myriad challenges faced by IPs.3

The purposes for which the I&B Fund can be utilised are equally crucial. Its primary objective should be to facilitate better outcomes from CIRP and liquidation processes while safeguarding the interests of IPs and the service providers they engage. This includes, but is not limited to, the payment of fees and expenses to IPs in cases where the Corporate Debtor has no assets or where there are inordinate delays in payment. Consider the example of a liquidator who has successfully completed the liquidation process, distributed proceeds to stakeholders, but remains unrelieved from duties due to pending litigation or investigations against the corporate debtor. In such a scenario, the liquidator might be compelled to continue responsibilities without remuneration due to a resource crunch. The I&B Fund could provide a minimum fee to such liquidators, ensuring their continued engagement and the eventual closure of the process.

Beyond direct payments, the I&B Fund could also provide interim finance for running the Corporate Debtor as a going concern, a critical aspect often overlooked due to financial constraints. It could also serve as a source of litigation funding for Corporate Debtors to realise claims receivable, thereby maximising the resolution value. Furthermore, the Fund could address specific challenges faced by IPs, such as the reluctance of the CoC to fund critical costs like updating books of accounts prior to the Insolvency Commencement Date or conducting forensic/transaction audits. Without these audits, IPs are often unable to file applications for Preferential, Undervalued, Fraudulent, and Extortionate (PUFE) transactions, hindering the recovery process. The I&B Fund could bridge these gaps, empowering IPs to fulfil their onerous responsibilities without being constrained by financial limitations.

Another significant issue the I&B Fund could alleviate is the inordinate delay in funding CIRP/liquidation costs by the CoC. In multi-creditor scenarios, some financial creditors might not contribute their share, jeopardising the entire process. The Fund could step in to bridge this gap, ensuring continuity. Moreover, when a higher court grants a stay on the CIRP process, the CoC often ceases payment of CIRP costs and fees to the Resolution Professional. Despite the stay, the RP’s duties are not paused, making it extremely difficult to operate without resources. The I&B Fund could provide the necessary support during such periods of judicial delay or stay. Finally, the Fund could address the lack of clarity regarding fees payable to Resolution Professionals for conducting the Personal Insolvency Resolution Process (PIRP) under Part III of the IBC. IPs often incur costs for legal counsel and report preparation, with no clear provision for reimbursement, leading to instances where they are not paid for their efforts. The I&B Fund could ensure that IPs are compensated for their crucial role in PIRP, even when applications are settled between the creditor and debtor, leading to termination of the PIRP.

The effective administration of the I&B Fund is paramount. While Section 224(4) mandates the Central Government to appoint an administrator, it is suggested that a committee with fair representation from IPs be constituted to advise on the utilisation of the fund based on the facts of each case. This would ensure that the Fund’s deployment is informed by practical realities and tailored to the specific needs of insolvency proceedings.

In conclusion, the Insolvency and Bankruptcy Fund is a vital instrument for strengthening India’s insolvency ecosystem. The experience gained over the past eight years of IBC’s implementation unequivocally demonstrates the pressing need for its operationalisation. By augmenting its sources of funds through mandatory contributions from successful resolution applicants and bidders, and by clearly defining its utilisation for purposes such as interim finance, litigation funding, and timely payment of IP fees and costs, the I&B Fund can alleviate numerous challenges faced by insolvency professionals. While these mechanisms have been widely discussed, they await formal recognition through statutory or regulatory amendments. It can ensure that CIRP and liquidation processes are not hampered by cost constraints, that critical audits and statutory compliances are undertaken, and that the interests of all stakeholders are protected. The operationalisation of the I&B Fund will contribute to an efficient and equitable insolvency regime in India.

Citations

- Report of the Insolvency Law Committee, March 2018, available at: https://www.ibbi.gov.in/ILRRe port 2603_03042018.pdf

- Report of the Insolvency Law Committee, May 2022, available at: https://ibbi.gov.in/uploads/wha tsnew/7c9bde175431a4abb8c33bb105e1f2dd.pdf

- The Need for an Insolvency and Bankruptcy Fund, Vikram Kumar, available at: https://www. iiipicai.in/wp-content/uploads/2025/05/30-35-Article-The-need-for-an-Insolvency-and-Bankruptcy-Fund-Vikram-Kumar.pdf

Expositior(s): Adv. Khushboo Saraf