Introduction

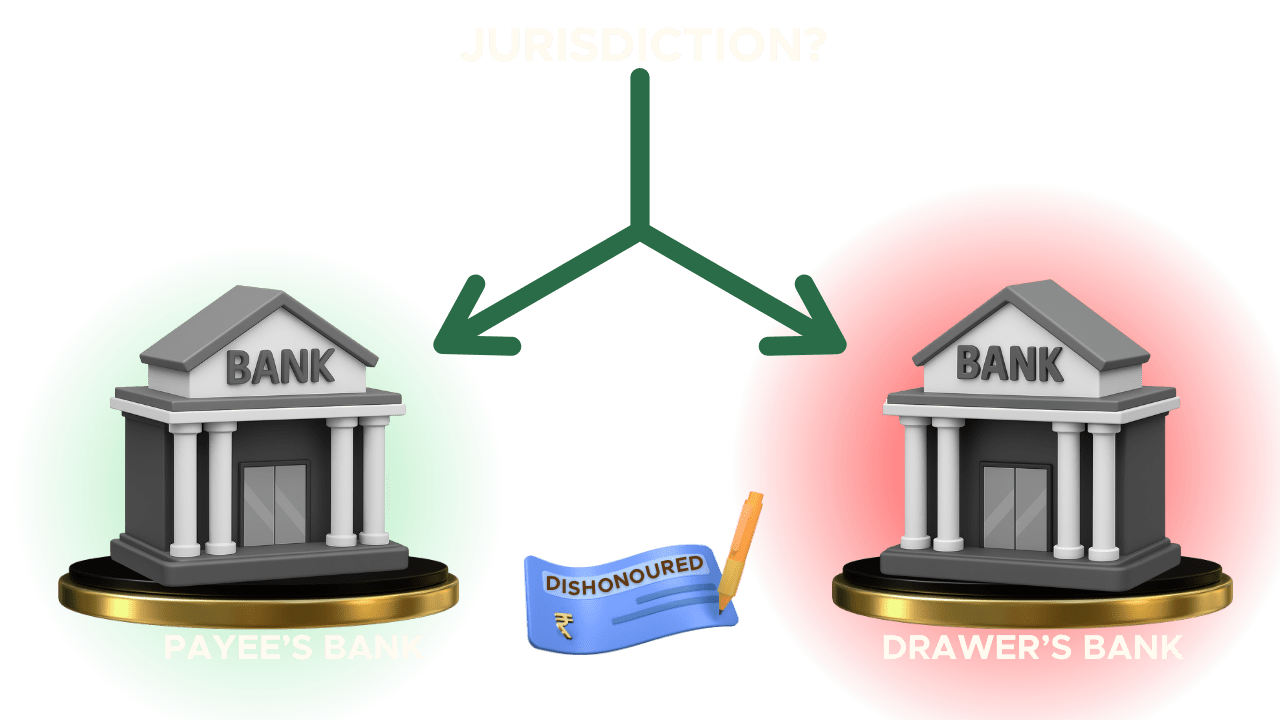

The Supreme Court of India, in a significant judgement M/s Shri Sendhuragro and Oil Industries Pranab Prakash v. Kotak Mahindra Bank Ltd. has firmly reiterated the jurisdictional principle for filing cheque dishonor complaints under Section 138 of the Negotiable Instruments Act, 1881 (NI Act). A bench comprising Justices JB Pardiwala and R Mahadevan has clarified that such complaints must be instituted in the court having jurisdiction over the branch of the bank where the payee maintains their account and where the cheque was presented for collection. This pronouncement, referencing the 2015 amendment to the NI Act, aimed to settle the long-standing ambiguity surrounding the appropriate forum for these cases.

The primary issue before the bench arose from a transfer petition seeking the relocation of a cheque dishonor case from Chandigarh to Coimbatore. The petitioner argued that since the entire underlying transaction occurred in Coimbatore, the Chandigarh court lacked jurisdiction. This contention directly challenged the jurisdictional framework established by the 2015 amendment to the NI Act.

The petitioner’s central argument rested on the premise that the location of the underlying transaction should determine the jurisdiction for the cheque dishonor complaint. They contended that since the loan transaction, the equitable mortgage of properties, and the deposit of money all took place in Coimbatore, the legal proceedings should also be initiated there. This argument essentially sought to prioritize the place of the transaction over the place of cheque presentation.

However, the Supreme Court decisively rejected this argument, upholding the principle enshrined in Section 142(2)(a) of the NI Act, as amended in 2015. The Court’s judgment underscored that the legislative intent behind the amendment was to clearly establish jurisdiction based on the location of the payee’s bank where the cheque is presented for collection. Justice Pardiwala, authoring the judgment, explicitly stated that “a conjoint reading of Section 142(2)(a) along with the explanation thereof, makes the position emphatically clear” that the relevant jurisdiction lies where the payee’s bank branch is situated and the cheque is presented.

The rationale behind the Court’s decision is firmly rooted in the statutory provisions introduced by the 2015 amendment. The Court emphasized that the amendment was specifically enacted to address the confusion stemming from the Dasrath Rupsingh Rathod v State of Maharashtra judgment, which had held that jurisdiction was determined by the location of the drawer’s bank. The amended Section 142(2) explicitly designates the court where the payee’s bank branch (where the account is maintained and the cheque is presented) is located as having jurisdiction.

Furthermore, the Court clarified the significance of the term “delivered” in Section 142(2)(a), stating that its importance is secondary to the expression “for collection through an account.” The act of presenting the cheque for collection at the payee’s bank is the decisive factor in determining jurisdiction. In the present case, as the cheque was presented for collection at a bank branch in Chandigarh where the respondent maintained an account, the Chandigarh court rightfully possessed the jurisdiction to entertain the complaint.

The Court also addressed the petitioner’s plea for transfer based on inconvenience, citing the difficulty of traveling from Coimbatore to Chandigarh. Relying on Section 406 of the Code of Criminal Procedure (CrPC), the Court held that mere inconvenience to the accused is not a valid ground for transferring a case, especially when the court where the complaint is filed has proper territorial jurisdiction. Justice Pardiwala explicitly stated, “Mere convenience or hardship that the accused may have to face in travelling would not fall within the expression ‘expedient for the ends of justice‘.” The Court outlined specific circumstances under Section 406 CrPC that could justify a transfer, such as the possibility of a biased prosecution, threat to witnesses, or a communally charged atmosphere, none of which were applicable in this case.

Interestingly, the judgment also touched upon a batch of similar transfer petitions, including the lead case Kedar Bhausaheb Malhari vs. Axis Bank Limited, currently pending before the Court. In these cases, the central question is whether a cheque dishonor complaint can be transferred to the jurisdiction of the drawer’s bank, a scenario seemingly barred by the 2015 amendment. The Court’s firm stance in the present case, upholding the payee’s bank jurisdiction, suggests a potential reluctance to deviate from the statutory mandate even when considering the convenience of the drawer. The arguments raised by the Amicus Curiae in the Kedar Bhausaheb Malhari case, highlighting potential hardship to the accused and the possibility of misuse of jurisdiction by complainants, will likely be crucial in the Court’s final decision on those petitions.

Conclusion

The Supreme Court’s recent ruling provides a clear and unambiguous interpretation of the jurisdictional provisions for cheque dishonor complaints under the amended NI Act. By firmly establishing the jurisdiction of the court where the payee’s bank is located and the cheque is presented for collection, the Court has reinforced the legislative intent behind the 2015 amendment. Moreover, the judgment clarifies that mere inconvenience to the accused is not a sufficient ground for transferring a case under Section 406 CrPC when the initial court possesses proper territorial jurisdiction. This ruling offers much-needed clarity to legal practitioners and litigants dealing with cheque dishonor cases, while the pending Kedar Bhausaheb Malhari case will further illuminate the Court’s stance on the limits of its transfer powers in light of the amended NI Act.

- Transfer Petition (CRL) No. 608 Of 202

- 2014 INSC 514