Introduction

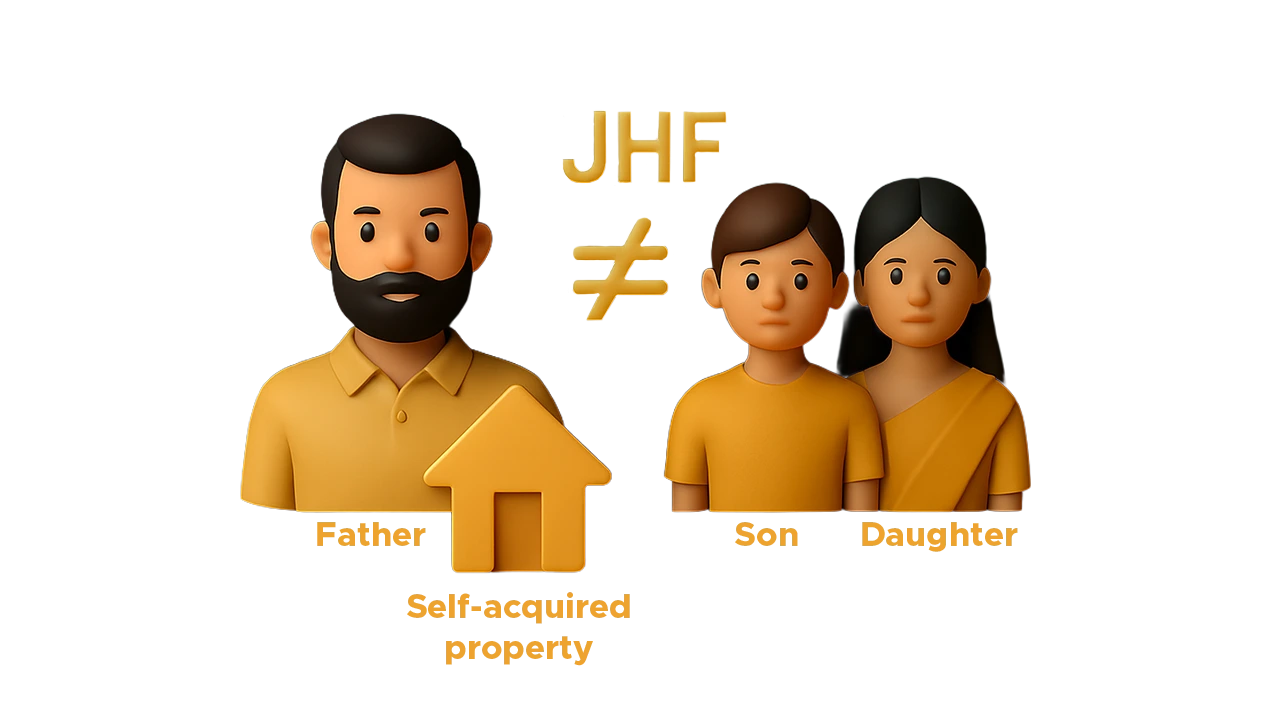

In a significant pronouncement, the Supreme Court of India, in the case of ANGADI CHANDRANNA VERSUS SHANKAR & ORS.1, has firmly reiterated the settled principle of Hindu law that the mere presence of sons and daughters in a JHF2 does not automatically transform the father’s separate or self-acquired property into joint family property. This crucial judgment, delivered by a two-Judge Bench comprising Justice J.B. Pardiwala and Justice R. Mahadevan, came while adjudicating a Civil Appeal filed by a property purchaser challenging a Karnataka High Court ruling that had overturned a Civil Judge’s decree. The Apex Court’s decision underscores the importance of clearly establishing the nature of property ownership within a Hindu family and the limitations on presuming joint family status.

The genesis of this legal battle lies in a suit for partition filed by the sons and daughters against a property purchaser. The father had acquired the suit property through a registered Sale Deed from his elder brother, subsequent to a partition of ancestral properties amongst himself and his two brothers after the demise of their father and uncle. He later sold this suit property to the Appellant. The Trial Court initially decreed the suit in favor of the sons and daughters, holding them entitled to partition. However, the First Appellate Court reversed this decision. The High Court, in a Regular Second Appeal, then set aside the First Appellate Court’s judgment, leading the purchaser to approach the Supreme Court.

The Supreme Court, after meticulously examining the facts and circumstances, emphasized a fundamental tenet of Hindu law: there is no inherent presumption that a property belongs to a joint family solely because a joint Hindu family exists. The onus of proving that a property is joint family property rests squarely on the party asserting such a claim. The Court elucidated that if the claimant successfully demonstrates the existence of a nucleus (joint family funds) with which the property could have been acquired, the presumption shifts. In such a scenario, the burden then falls upon the individual claiming the property as self-acquired to prove that the purchase was made using their personal resources and not from the available joint family nucleus. Significantly, the Court cautioned that this nucleus must be established as a matter of fact and cannot be merely presumed or assumed based on probabilities.

Furthermore, the Bench addressed the High Court’s reliance on the argument that the father’s use of sale proceeds for his daughter’s marriage indicated the property’s joint family character. The Supreme Court countered this by stating that performing the marriage of a daughter is a customary duty of the Kartha(manager) of a Hindu family and expenses incurred for this purpose are considered acts of necessity. Therefore, the utilization of funds for such a purpose does not automatically bestow the character of joint family property on the asset from which the funds originated. The Court also reiterated the established legal position that once joint family property is legally partitioned, the individual shares become the self-acquired property of the respective sharers, granting them complete autonomy over their share.

Turning its attention to the Doctrine of Blending, the Supreme Court clarified that a member of a joint Hindu family can impress their separate or self-acquired property with the character of joint family property by voluntarily throwing it into the common stock with the clear intention of relinquishing their separate claim. However, the Court explicitly stated that a clear intention to waive separate rights must be unequivocally established. Allowing other family members to use the property jointly, utilizing income from separate property to support family members (out of generosity or even obligation), or the failure to maintain separate accounts are insufficient grounds to infer such an intention of blending. The Court cited the precedents of Lakkireddi Chinna Venkata Reddy & Ors. v. Lakkireddi Lakshamama3 and K.V. Narayanan v. K.V.Ranganandhan & Ors4. to underscore that acts of generosity or kindness do not equate to an admission of a legal obligation to blend self-acquired property. In the present case, the Court found no evidence to suggest that the suit property, acquired independently by the father, had been voluntarily blended with any joint family property.

The Supreme Court expressed its disapproval of the High Court’s approach, noting that it had erroneously re-appreciate evidence without framing any substantial question of law, which is a prerequisite under Section 100 of the CPC5. The Apex Court emphasized that the High Court’s power to interfere with the factual findings of the First Appellate Court is limited to instances where there is a failure to consider law or evidence, consideration of inadmissible evidence, or a decision rendered without evidence, as outlined in Section 103 of the CPC. The Court found that the First Appellate Court had diligently analyzed the evidence and arrived at a plausible conclusion, which the High Court should not have overturned simply because another view might be possible. The Court also referred to its earlier judgment in Chandrabhan (Deceased) through L.Rs & Ors. v. Saraswati & Ors6., highlighting that the re-appreciation of evidence is primarily within the domain of the First Appellate Court and not the High Court under Section 100, unless exceptional circumstances under Section 103 are met.

Conclusion

The SC allowed the appeal, setting aside the judgment and order of the High Court and restoring the judgment and decree of the First Appellate Court. This decision serves as a significant reaffirmation of the distinct nature of self-acquired property within a Hindu family and underscores the necessity of concrete evidence to establish a claim of joint family property or the blending of self-acquired property. The judgment provides crucial clarity on the principles governing property ownership in Hindu law, protecting the rights of individuals over their self-acquired assets while upholding the established legal framework for joint family property.

CITATIONS

- Angadi Chandranna Versus Shankar & Ors. 2025 INSC 532, Civil Appeal No. 5401 of 2025

- Lakkireddi Chinna Venkata Reddy & Ors. v. Lakkireddi Lakshamama (1964) 2 SCR 172

- K.V. Narayanan v. K.V.Ranganandhan & Ors 1976 AIR 1715

- Chandrabhan (Deceased) through L.Rs & Ors. v. Saraswati & Ors 2022 INSC 997

- Civil Procedure Code,1908

- Chandrabhan (Deceased) through L.Rs & Ors. v. Saraswati & Ors 2022 INSC 997

Expositor(s): Adv. Archana Shukla