Introduction

The intersection of the Insolvency and Bankruptcy Code (IBC) and Intellectual Property (IP) law presents a profound legal paradox: the statutory mandate to maximize the value of a Corporate Debtor’s assets versus the necessity of protecting a trademark’s brand integrity and legal ownership. As insolvency filings rise, a recurring jurisdictional friction has emerged where litigants attempt to settle complex, pre-existing trademark title disputes within the summary proceedings of the National Company Law Tribunal (NCLT). By leveraging the broad residuary powers of Section 60(5), creditors often seek to pull disputed IP assets into the resolution estate. However, recent judicial clarity has established that while the IBC is a “single-window” clearinghouse for insolvency, it is not a “Title Court” for independent civil disputes.

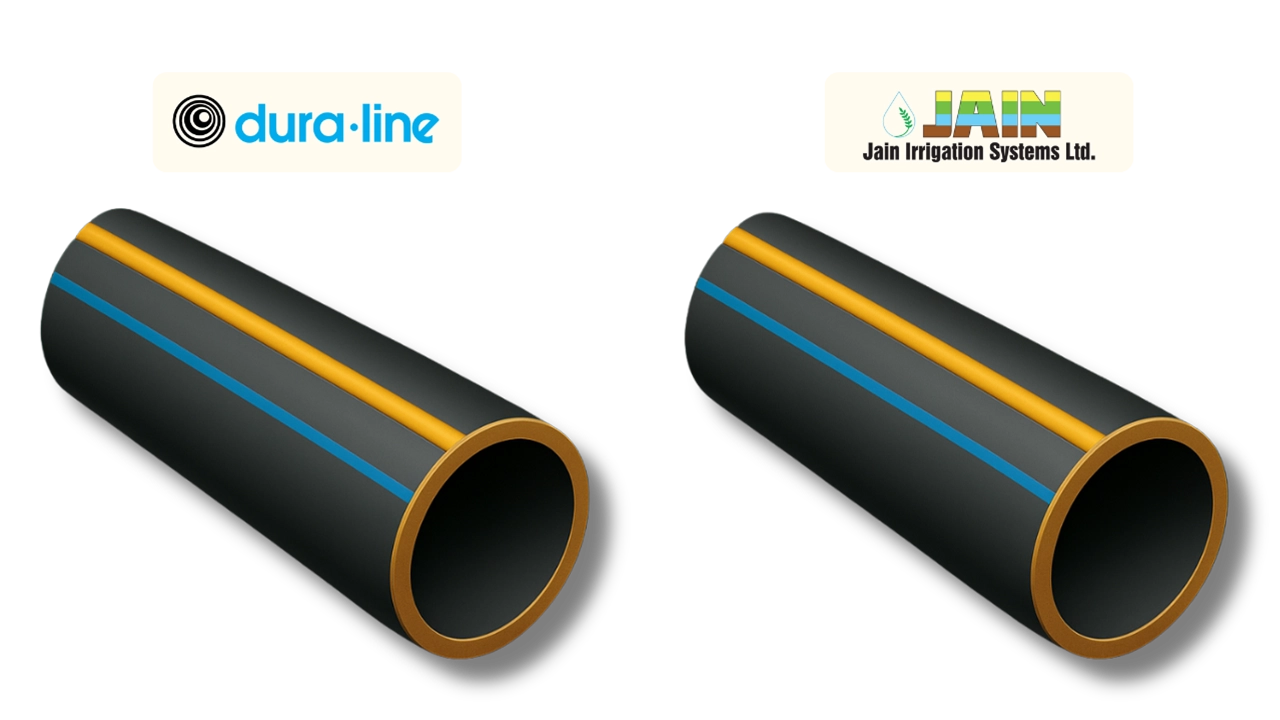

This jurisdictional boundary was sharply defined in the landmark case of Gloster Ltd. v. Gloster Cables Ltd. (2026)1. The factual matrix centered on the ownership of the trademark “GLOSTER,” which had been assigned to the respondent through a 2017 Deed of Assignment long before the commencement of the Corporate Insolvency Resolution Process (CIRP). During the insolvency proceedings of the parent company, the NCLT used its plan-approval powers to effectively nullify this assignment, declaring the trademark an asset of the debtor to facilitate a “cleaner” sale to the successful bidder. The matter reached Supreme court primarily as the matter was a fundamental disagreement over the NCLT’s jurisdiction. While the NCLAT had ruled on the merits of the trademark ownership, it also held that the NCLT possessed the authority to decide such intellectual property disputes under Section 60(5) of the IBC. Gloster Cables Ltd. challenged this specific legal conclusion, arguing that an insolvency tribunal is not the appropriate forum for determining complex civil titles. Supreme Court eventually ruled that a Resolution Plan cannot “create” ownership where the title is already contested under private civil law.

The Limits of Section 60(5)

The core legal logic limiting the NCLT’s reach rests on the distinction between Insolvency Jurisdiction and Statutory Adjudication. While Section 60(5)(c) grants the NCLT power over matters “arising out of or in relation to” insolvency, this does not grant it the authority to usurp the role of a Civil Court or the Trade Marks Registry. The court identified a growing conflict between the Residuary Power Section 60(5)2 and the Adjudicatory Limits of a summary tribunal. For instance, declaring a trademark assignment as “preferential” or “undervalued” under Sections 43 or 453 requires specific pleadings, evidence, and notice; the NCLT cannot simply issue “avoidance findings” as an incidental part of approving a resolution plan.

This “Nexus Rule” has seen a steady judicial evolution. It began with Embassy Property Developments (2019)4, which clarified that the NCLT cannot decide matters involving administrative discretion or statutory rights independent of insolvency. This was further refined in Gujarat Urja Vikas Nigam v. Amit Gupta5, where the Court held that a dispute falls under NCLT’s purview only if it has a direct nexus to the insolvency process meaning the dispute would not have existed but for the CIRP. By the time of the Gloster ruling in 2026, the law had solidified: trademark ownership, rooted in specialized IP contracts, exists independently of a company’s financial distress and must be resolved in the appropriate civil forum.

Striking a balance between commercial expediency and the rule of law is essential for the IBC’s success. While the NCLT must ensure the Corporate Debtor remains a going concern, it cannot do so by overriding settled principles of property law. Allowing the NCLT to settle complex title disputes would “open a Pandora’s box,” diluting the finality of resolution plans and inviting endless litigation. Ultimately, the NCLT must respect the boundaries of its specialized jurisdiction, ensuring that while debts are resolved, the sanctity of intellectual property remains governed by the courts equipped to handle them.

Conclusion

The resolution of a corporate debtor cannot serve as a convenient bypass for the complexities of property law. While the IBC is designed for speed and commercial revitalization, the judiciary has made it clear that “commercial wisdom” does not grant the NCLT the power to rewrite history or manufacture titles. By strictly applying the “Nexus Rule,” the courts have ensured that the NCLT remains an efficiency-driven tribunal rather than an all-encompassing court of original jurisdiction. Striking this balance is vital: it protects the finality of the insolvency process while ensuring that the sanctity of intellectual property remains governed by the specialized laws and civil forums meant to protect them. In the race to save a company, the rule of law regarding ownership must not be left behind.

Citations

Expositor(s): Adv. Jahnobi Paul